About Us

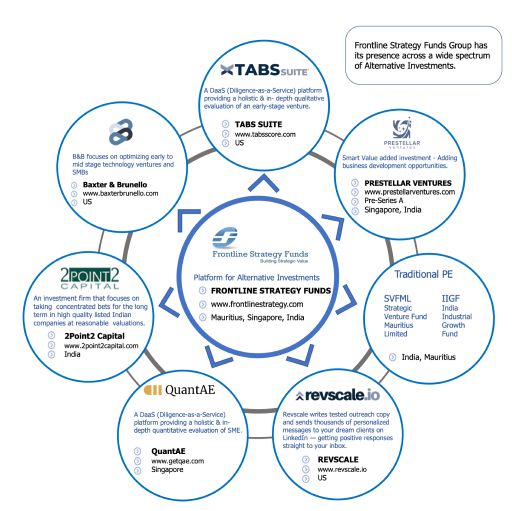

Frontline Strategy is a specialist Private Equity Advisory Firm providing growth capital and expertise to businesses primarily focused on India. It is increasingly looking at USA, Singapore and ASEAN region for further investment opportunities. Incorporated in Mauritius in 2000, Frontline Strategy has targeted growth oriented companies for investment with verified proof of concept.

With a new MAS registered Venture Capital Fund Management Company incorporated in Singapore in 2018, the company has grown into a successful investment group (namely Frontline Strategy Funds Group) with an extensive and diversified private equity investment portfolio.

Over the years, Frontline Strategy Funds Group has built its success on its extensive experience and industry insight. The Group with its rich experience in the Venture Capital / Private Equity industry aims to invest in emerging and growth oriented companies in its targeted geographies.